Operating Environment

Context matters. Especially for a systemically important bank like the Commercial Bank. The Bank’s position, performance, and value delivery are intrinsically linked to the socio-political, economic trends in the global arena and in Sri Lanka. The following section outlines the latest developments in the global and the local economies as well as the emerging trends in the Sri Lankan banking sector that played a key role in shaping Commercial Bank in the year 2018.

Accelerated pace of change and key technological advances within the last decade have driven the sector to revisit conventional strategies and revamp business models. The Bank is well aware that the coming decade will bring about a plethora of changes, and is strategically prepared to weather any storm, capitalise on opportunities, and drive innovation.

Global economy Table – 03

| GDP Growth rate |

2017 % |

2018

(Estimated) % |

2019

(Projected) % |

| World Output | 3.8 | 3.7 | 3.5 |

| Advanced Economies | 2.4 | 2.3 | 2.0 |

| United States | 2.2 | 2.9 | 2.5 |

| Euro Area | 2.4 | 1.8 | 1.6 |

| Japan | 1.9 | 0.9 | 1.1 |

| United Kingdom | 1.8 | 1.4 | 1.5 |

| Emerging Market and Developing Economies | 4.7 | 4.6 | 4.5 |

| Russia | 1.5 | 1.7 | 1.6 |

| China | 6.9 | 6.6 | 6.2 |

| India | 6.7 | 7.3 | 7.5 |

| ASEAN-5 | 5.3 | 5.2 | 5.1 |

Source: IMF World Economic Outlook Update January 2019

Global economy is estimated to have grown by 3.7%, a marginal decrease from the growth of 3.8% recorded in 2017, but remained resilient supported by activity in advanced economies including the US, the UK, and Japan. Global activity was impacted by the accelerated growth in the US economy, the trade war between China and the US, uncertainty in the European markets resulting from Brexit, and the strengthening US dollar leading to a tightening of financial conditions within the emerging markets.

The US markets are expected to remain strong in the near term supported by strong labour market conditions, solid corporate profits, increase in oil production, and favourable financial conditions. Marking the eighth rate hike since 2015, the US Federal Reserve raised the target federal funds rate by 0.25%, taking it to a target range of 2.25% – 2.50% in December 2018. These activities led to a strengthening of the US Dollar during the year. 2018 was defined by the ongoing trade war between China and the US, which will continue to affect the markets of both countries and the world economy as a whole. In the United Kingdom GDP growth was strong, partially reflecting an increase in Government spending while the Japanese economy contracted largely due to factors related to natural disasters. The European markets display a downward trend in growth largely driven by the uncertainty that surrounds Brexit, though the markets have time to assess and premeditate its impact.

The financial conditions have eased in China with prompt action by the People’s Bank of China reacting to the grim outlook, amidst domestic imbalances and rising trade tensions. Chinese policy is now swinging firmly from tightening to stimulus as the leadership gears for the impact of tariffs.

The growth in Emerging Markets (EM) decelerated in 2018 as a result of tightening of financial conditions due to higher interest rates in the US which resulted in strengthening of the US Dollar. The outlook for EM economies is not that strong especially due to country-specific factors, tighter financial conditions, geopolitical tensions, and higher oil import bills.

Oil prices remained extremely volatile in 2018 and could continue to do so into 2019. However, due to increasing production and resilient shale growth in the US, coupled with weak demand stemming from the concerns of the US-China trade war and political uncertainty in the European markets, prices could be expected to stabilise around USD 55-65 per barrel for Brent crude in 2019. International gold price fell nearly by 5% in 2018 as investors moved away from the gold market due to rising equity markets. However, the gold market is expected to pick up in 2019.

Looking ahead to 2019, global trade is expected to remain subdued. The impact of the trade war was contained to a certain extent in 2018, but is expected to affect trade especially in the US and China to a larger extent in 2019. Global growth is expected to decelerate to 3.5%. Downside risks include the tightening of global financial conditions impacting EMs, uncertainties regarding China’s reforms process, and geopolitical uncertainties including risks related to Brexit.

Sri Lankan economy

The Sri Lankan economy experienced a turbulent year with GDP growth reaching 3.3% in the first nine months of 2018. It is well below the IMF and the ADB forecasts for 2018 of 4.3% and 3.8% respectively and comparatively lower than other economies in the region that has experienced GDP growth of up to 7%. The sub-par economic performance in Sri Lanka was partially due to heightened challenges in the global financial and geopolitical arena that greatly affected the external sector. Similarly domestic challenges like stagnant fixed investment, weak domestic demand and investment, tightening of monetary policy, and political instability that loomed over the island in the fourth quarter which led to inconsistent economic policies, affected macroeconomic stability.

The agricultural sector rebounded to reach a growth of 4.3% in the nine months ended September 30, 2018, while the services sector too expanded by 4.4%. The tourism industry recorded an increase of 11.6% in earnings to post USD 3,211.9 Mn. mainly due to arrivals which grew by 11.6% to reach 1.7 million visitors while the construction sector fell by 0.4% in nine months ended September 30, 2018, displaying the predicted slowdown of industrial activities in 2018.

The trade deficit widened to USD 7,953 Mn. in nine months ended September 30, 2018, an increase of 16% in comparison to 2017 as a result of import expenditure growth of 10.4% outpacing export earnings growth of 5.6%. Capital outflows, particularly from Government rupee securities, the tightening conditions in the global markets, the strengthening of the US dollar in view of monetary policy normalisation and speculation in the domestic market exerted pressure on the exchange rate. As a result, despite several short term measures taken to relieve the pressure, the Sri Lankan Rupee (LKR) depreciated by 19% against the US dollar in 2018, the sharpest decline in a decade. The gross official reserves of the country declined to USD 6.9 Bn. (equivalent to 3.7 months of imports) by end 2018 from USD 8.0 Bn. (equivalent to 4.6 months of imports) reported in 2017.

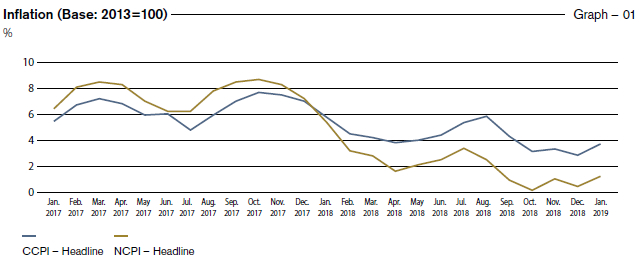

Headline inflation remained in low single digit levels while core inflation too remained subdued. The tight monetary policy continued in 2018 as well. The Government initiated several structural reforms such as the implementation of the new Inland Revenue Act and the introduction of Fuel Pricing Formula in keeping with its policy of revenue driven fiscal consolidation.

It is encouraging to note that, Sri Lanka was named the No. 1 destination to visit in 2019 by Lonely Planet. This will boost

Sri Lanka’s chances of achieving the tourist arrival targets and increase annual earnings from the industry. Sri Lanka also climbed up 11 places to be ranked 100 among 190 countries in the Ease of Doing Business Index compiled by the World Bank. However, three major credit rating agencies Standard & Poor’s, Moody’s, and Fitch Ratings, in November 2018 downgraded Sri Lanka’s sovereign rating despite reservations of many other analysts. A higher rate of inflation could also be expected due to potential risks arising from global commodity prices, inclement weather, and the impact of rupee depreciation on domestic prices.

It is reported that Sri Lanka will have USD 5.9 Bn. external debt repayments in 2019 included an international sovereign bond of USD 1 Bn. which matured in January and was repaid.

Sri Lankan banking sector

The financial sector performed reasonably well despite the turbulent market conditions referred to above. While the non-banking sector experienced a slowdown, the banking sector of Sri Lanka recorded favourable levels of asset growth as well as improvements in liquidity and capital levels. The Central Bank of Sri Lanka (CBSL) implemented several prudent measures to maintain a stable financial system and to strengthen the resilience of the financial system to external challenges.

In 2018 (guidelines issued much earlier), the CBSL issued directions on Basel III liquidity standards, net stable funding ratio, leverage ratio, foreign currency borrowings by Licensed Commercial Bank s (LCBs) to bolster risk management aspects and to promote transparency and prudent practices with regard to foreign borrowings. The CBSL also issued guidelines to licensed banks for the adoption of SLFRS 9 on Financial Instruments, the implementation of which will ensure that the Sri Lankan banking sector is in line with international best practices.

The CBSL continued the tight monetary policy and widely used Open Market Operations (OMOs) to facilitate market liquidity. However, due to the persistent liquidity deficit in the domestic money market, the Monetary Board reduced the Statutory Reserve Ratio (SRR) applicable on all rupee deposit liabilities of commercial banks to 6.00% from 7.50% in November 2018. The reduction in SRR released a substantial amount of rupee liquidity to the banking system, which could have led to a reduction in interest rates and excess aggregate demand. In order to neutralise the impact of the SRR reduction and maintain its neutral monetary policy stance, the CBSL simultaneously raised Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) to 8.00% and 9.00% respectively.

With the objective of curtailing import expenditure, the Government introduced a 200% LC margin while lowering the loan to value ratio on vehicle imports and imposed a 100% cash margin requirement on selected consumer goods imports with effect from October 1, 2018. These measures had a marginal impact on the industry in 2018, but is expected to hinder the trade finance volumes going forward.

Market interest rates stabilised at high levels causing the growth rate of credit granted by commercial banks to the private sector to decelerate during major part of the year. However, the latter part of the year saw signs of acceleration in the market.

Assets of the banking sector grew by 14.6% to reach Rs. 11.8 Tn. at the end of 2018, a significant growth compared to the growth of 13.8% recorded in 2017. Total loans and advances, which accounted for 65.2% of total assets grew by 19.6% primarily supported by growth in term loans and overdrafts. Both the banking as well as the non-banking financial services sectors experienced a substantial deterioration in asset quality with the gross and net Non-Performing Ratio (NPL) ratios of the banking sector rising to 3.4% and 2.0% respectively as at end 2018 compared to 2.5% and 1.3% a year ago. Deposits too recorded a satisfactory growth of 14.8% during the year. However, due to the shift in deposits from current accounts and savings accounts (CASA) to time deposits with the increasing gap in interest rates between them, CASA ratio of the banking sector declined to 32% by end 2018 from 34.2% in 2017.

Reflecting the growth in business volumes, interest income and interest expenses grew by 14.0% and 12.8% respectively, leading to a growth of 16.3% in net interest income. Sharp depreciation of the Sri Lankan Rupee also contributed to a growth of 21.0% in non-interest income. Yet, the sector failed to record a growth in profit before tax due to increase in operating expenses by 23.9% and impairment provisioning by 34.7%. In addition, banks were required to comply with the requirements of SLFRS 9 effective from January 01, 2018, resulting in the banks having to absorb the shortfall in provisions at the transition day which ranged around 30% to 50% of the cumulative impairment provision up to end of 2017 through the Statement of changes in Equity. Further, the introduction of SLFRS 9 resulted in a substantial increase in impairment provision for the year due to the shift in focus from the incurred loss to expected loss.

Increase in taxation due to the implementation of the new Inland Revenue Act effective from April 1, 2018 and the introduction of Debt Repayment Levy effective from October 1, 2018, saw the profit after tax dip by 9.1%.

The additional impairment provisions coupled with the increased tax burden exerted added pressure on the industry bottom lines, squeezing the regulatory capital of banks, making it arduous for the industry to meet the increased capital adequacy requirements imposed by the regulator effective from January 2019 and making the sector less attractive for investors.

In order to strengthen the legal and regulatory framework of the financial institutions, a new Banking Act is being drafted, while initiating amendments to other legislation related to the financial sector. The CBSL is planning to introduce a more cost reflective alternative benchmark interest rate, which will be based on the marginal cost of banks, to improve the banking sector’s competitiveness. Further, the CBSL is in the process of introducing a superior alternative USD/LKR reference rate for the benefit of all stakeholders, including foreign investors.

The CBSL entered into an MoU with the Securities and Exchange Commission of Sri Lanka (SEC) and the Insurance Regulatory Commission of Sri Lanka (IRCSL) to conduct effective consolidated risk-based supervision, enabling group-wide assessment of contagion and reputation risks that may emanate from relationships among members of corporate groups operating across different financial sub-sectors to contain systemic risk

In the new age of technology, ICT security has become a key concern, especially for banks that may be targets for cyber attacks and information security breaches. The CBSL has issued guidelines to the sector to improve resilience to such threats in line with international standards. The National Card Scheme “LankaPay” was launched in 2018 and commenced issuing LankaPay cards to customers and this initiative will continue in 2019 under the guidance of the CBSL.

In 2019, the banking sector will also delve more into virtual banking platforms, digital payment mechanisms, and integrate ICT in operations to move towards a cashless society while enhancing privacy, safety, and convenience.

To encourage virtual banking platforms, the National Payment Council appointed committees to study the latest developments in FinTech and Blockchain technologies to understand the emergence of new payment technologies in the world. As per the recommendations made by the FinTech Committee, a National Quick Response (QR) Code Standard for Local Currency Payments branded as “LANKAQR” was issued to all financial institutions and mobile phone based electronic money (e-money) systems operators to facilitate QR code based payments. Similarly, with regard to Blockchain technology, an inter-industry working committee is preparing a framework for a Blockchain based shared know-your-customer (KYC) solution.

Bangladesh economy

Bangladesh has made substantial progress in growing its economy, reducing poverty, and improving life expectancy, literacy rates and per capita food production, while also improving employment opportunities, and basic infrastructure. Asian Development Bank projects the GDP growth of the country to hover at 7.9% in 2018 and 7.5% in 2019, the highest among the South Asian region (https://www.adb.org).

Private consumption is expected to be underpinned by remittance growth, while strong Government consumption and investment are also expected to increase. This rapid growth has aided Bangladesh to reach lower middle-income country status in 2015. However, risks of natural disasters and a shaky global trade environment may cloud future prospects. Inflation for 2018 is forecasted at 5.8%, while it is expected to increase marginally to close at 6.3% in 2019.

Standard & Poor and Fitch issued a credit rating of BB- for Bangladesh with a stable outlook, while Moody’s credit rating was set at Ba3 with a stable outlook. Foreign direct investment in Bangladesh rose by 5.11% during the fiscal year 2017-18, from USD 2.45 Bn. in 2017 to USD 2.58 Bn. in 2018. The country is in an important juncture where it could move up the middle income bracket with right policies and action. The World Bank has identified the creation of job opportunities as the country’s top priority (www.worldbank.org). Over the past decade Commercial Bank of Ceylon PLC (CBC), Bangladesh, has been creating inroads to contribute towards this economic growth and improve the lives of its people.