About the Bank

Largest and systemically important

Commercial Bank of Ceylon PLC is the largest private sector commercial bank and third largest bank in Sri Lanka in terms of total assets, which stand at Rs. 1.303 Tn. (USD 7.123 Bn.) as at the end of 2018. It is a systemically important Bank in the country and accounts for 11.1% of sector assets, approximately.

A century old legacy

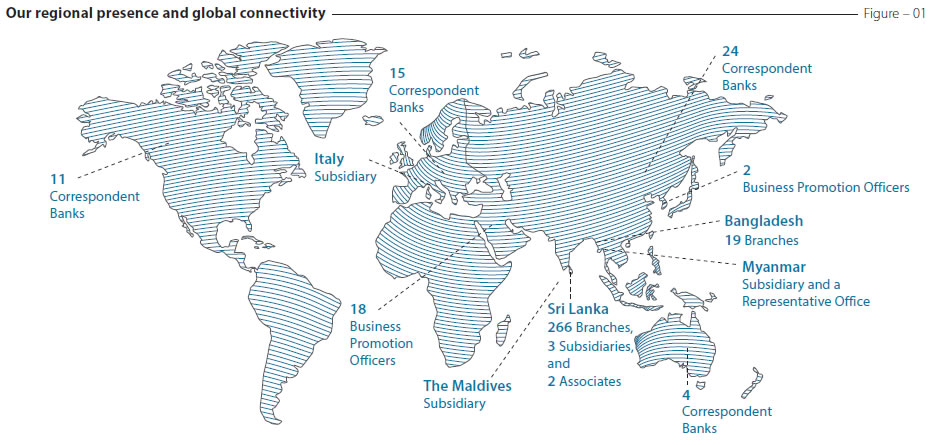

The Bank’s origins date back to 1920's, marking half a century under its present name. Commercial Bank of Ceylon PLC. Its 5,027 employees serve over three million customers through a wide local and international network of branches, subsidiaries, agency arrangements, Business Promotion Officers, in several Middle Eastern countries and correspondent banking relationships.

Growing international footprint

With the acquisition of the Bangladesh operations of Crédit Agricole Indosuez in 2003, the Bank began its expansion beyond Sri Lanka’s shores. So far it has established subsidiaries in Italy, the Maldives and in Myanmar which also has a representative office in Yangon.

Risk profile

Receiving the highest rating for a local private sector bank, Commercial Bank is rated AA(lka) with a stable outlook by Fitch Ratings Lanka Ltd. Its risk profile reflects a restrained risk appetite, a robust funding base, a secure level of liquidity, a sound domestic franchise and a consistently stable performance.

Diversification is a strength that spans the Bank’s four main business segments of Personal Banking, Corporate Banking, Treasury, and International Operations. Its international operations in Bangladesh, Maldives, Italy, and Myanmar now account for 10.55% of consolidated assets and 20.14% of consolidated profit before taxes. Customer deposits fund 75.42% of total assets, demonstrating the Bank’s strong domestic franchise.

Vibrant financial intermediation

Both loans to customers and deposits from customers grew by over Rs. 100 Bn. each for the fourth and third consecutive years respectively , endorsing its systemic importance to the industry.

For the past five years the Bank’s loans to deposits ratio was at 82.96 % on average with both loans and deposits growing correspondingly. This illustrates the robustness of the Bank’s financial intermediation and its ability to deploy funding resources at an optimum while pursuing productive assets. The Bank’s asset quality is one of the best in the industry, while its Current Account and Savings Account (CASA) make up 37.55% of total deposits, the highest among the peer banks.

Strong capitalisation

With the regulatory minimum being 8.875%, the Bank holds a Total Tier 1 ratio of 11.338% as at December 31, 2018 reflecting its capital strength and resilience. The Bank’s growth was prudent with gearing in terms of on-balance sheet assets as well as risk-weighted assets remaining at 10.85 times and 7.64 times as at end 2018.

Demonstrating the strength of the franchise, the Bank’s shares reported the highest price to Book Value of 0.98 times and the highest market capitalisation of Rs. 115 Bn. (USD 628 Mn.) among the Banking and Finance institutions and the third largest institution in terms of market capitalisation on the Colombo Stock Exchange as at December 31, 2018.

Ownership of the Bank

Of approximately 10,600 ordinary voting shareholders of the Bank, DFCC Bank PLC (13.56%), entities related to the State including Employees’ Provident Fund, Employees’ Trust Fund Board and Sri Lanka Insurance Corporation (19.84%), Mr Y S H I Silva (8.08%), NTAsian Discovery Master Fund (5.70%), Melstacorp PLC (4.61%) and International Finance Corporation (4.44%) are the major shareholders, holding an ownership stake of over 46%.